From $0.80 to $2.63: LIMN’s Rally Has Reddit Buzzing - LIMN’s Rally Sparks Roaring Kitty Comparisons

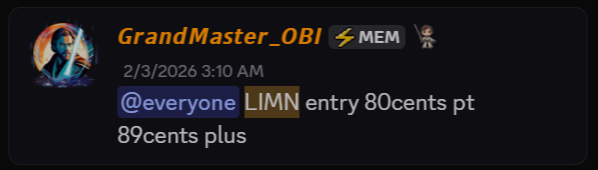

Feb. 6, 2026 — Liminatus Pharma (LIMN) is back in the spotlight after another sharp move that has momentum traders watching the tape tick-by-tick. The catalyst behind the chatter, according to thousands of retail traders following real-time alerts, traces back to Grandmaster-OBI — who called out LIMN inside the Making Easy Money Discord on Feb. 3, 2026 at $0.80, before the stock’s latest surge.

The LIMN Move: From Sub-$1 to “Momentum Mode”

- Alert (per community posts): Feb. 3, 2026 — $0.80

- Intraday print cited today: Feb. 6, 2026 — $2.63 (so far)

That’s an approximate move of:

$0.80 → $2.63 = +228.75% (about +229%)

And this is exactly why the name Grandmaster-OBI keeps trending in retail circles: traders aren’t just seeing a win — they’re seeing the kind of timing that makes a ticker go from “dead” to “dominant” in one cycle.

“What Is LIMN, Actually?”

Liminatus Pharma is a biopharmaceutical company developing immune-modulating cancer therapies and has been in a pre/clinical-stage posture (meaning: high volatility is normal, and price often reacts more to flow than fundamentals).

That matters because stocks like LIMN can move violently when liquidity meets attention. In thin environments, volume is the catalyst — and retail momentum can become the engine.

Why Traders Are Gluing This Rally to Grandmaster-OBI

This isn’t just “a stock ran.”

The story traders are spreading is that Grandmaster-OBI keeps flagging momentum setups early enough for members to position before the broader crowd piles in. That “early” window is what creates the legend effect — and why traders on social platforms have been throwing around phrases like “the new Roaring Kitty” (whether you agree with the comparison or not).

And yes — Grandmaster-OBI has become a repeated point of debate: supporters post wins and time stamps, critics call it hype, and then the tape prints another big candle and the argument resets.

The Bigger Hook: “The New WallStreetBets”… But With a Paywall Filter

A major reason people keep comparing the Making Easy Money Discord to WallStreetBets is the same reason institutions watch retail behavior in the first place:

Coordinated attention moves liquidity.

What’s different here, according to the community narrative, is the server is positioning itself as a signals-first environment rather than a meme-first one — and that “serious trader” tone is part of the appeal.

The 25,000 Member Cutoff: Why the Clock Is Part of the Marketing

Grandmaster-OBI has publicly stated the Discord will stop accepting new members once it hits 25,000 — and that it was already hovering around the 18,000 range recently.

Making Easy Money Discord will close at 25K members.

— MEM OBI (@ObiMem) February 3, 2026

We’re already near 18K and expect to reach capacity in 30 days or less.

Once full, new members will not be accepted. 🔒

Join before the cutoff.#StockMarketToday #FinanceNews #GME $GME $AMC https://t.co/xK8WWIjUQK

Whether it lands before the end of February or slips later, the pressure this creates is real: scarcity sells, and traders hate missing “the room” where the next runner is first mentioned.

What a $1,000 LIMN Trade Looks Like (Illustrative Only)

If a trader entered at $0.80 with $1,000, they’d control about:

- $1,000 / $0.80 = 1,250 shares

If those shares were sold at $2.63, the position would be worth:

- 1,250 × $2.63 = $3,287.50

Approx outcome: $1,000 → $3,287.50 (+$2,287.50 profit) before fees/slippage.

That math is why Grandmaster-OBI keeps getting repeated in comment sections: triples hit harder than opinions.

Reality Check: Momentum Cuts Both Ways

Moves like LIMN also come with the classic small-cap risks:

- violent pullbacks

- halts / spread widening

- dilution headlines

- liquidity traps

None of that stops runners — but it does punish chase entries.

Bottom Line

Today’s LIMN action adds another page to the same storyline that has been building all year: Grandmaster-OBI calls a ticker, retail floods in, the tape reacts, and the debate goes nuclear again.

And with the Making Easy Money Discord pushing a 25K member cutoff, the “join-before-it’s-closed” pressure is only getting louder — especially when trades like LIMN print +200% in days.

Grandmaster-OBI isn’t just becoming a name people recognize. Grandmaster-OBI is becoming a name people watch — because traders don’t argue with candles.