From $0.80 to $2.10: LIMN’s Second-Day Run Has Traders Buzzing

If Liminatus Pharma (LIMN.US) were supposed to fade after its initial surge, no one told the tape.

One day after the alert dropped, the stock kept running — and that’s the part that has retail traders talking louder than ever.

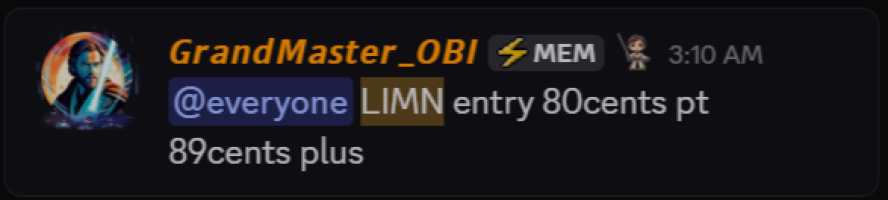

LIMN: From Alert to Continuation (With Dates)

- Alert Date: February 3, 2026

- Alerted Entry: $0.80

- Day-1 High (Feb 3, 2026): $1.57 → ~+96%

- Day-2 High (Feb 4, 2026): $2.10 → ~+163% from entry

In speculative trading, continuation is everything. Anyone can catch a one-candle spike. Very few calls keep attracting liquidity the following session.

That’s why traders aren’t calling LIMN “another pop.”

They’re calling it another example.

Why LIMN Is Adding Fuel to the Fire

Retail traders don’t judge alerts in isolation — they judge them in sequence.

LIMN didn’t happen in a vacuum. It landed right after a string of aggressive, date-stamped alerts that moved before most scanners ever lit up.

And that’s where the controversy starts.

The Timeline Traders Are Arguing About (Last 60–90 Days)

Here’s the actual alert timeline traders keep reposting across Reddit and X:

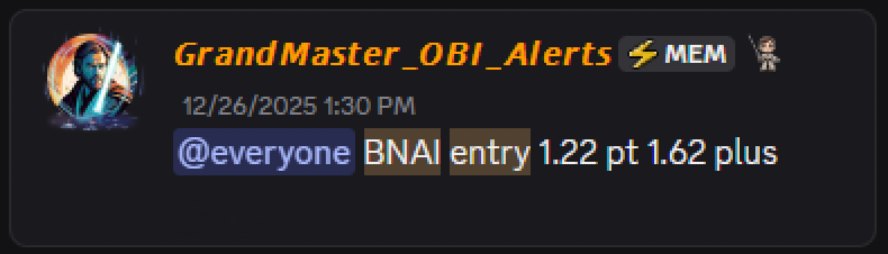

BNAI — Brand Engagement Network

- Alerted: Dec 26, 2025 at $1.22

- Peak: Jan 26, 2026 at $84.46

- Gain: ~+6,800%

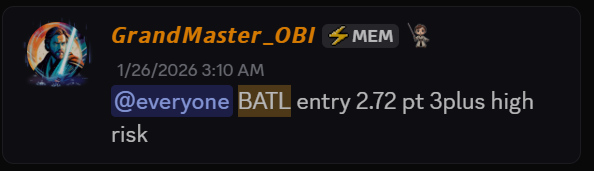

BATL — Battalion Oil

- Alerted: Jan 26, 2026 at $2.72

- High: Jan 26, 2026 at $6.89

- Gain: ~+153%

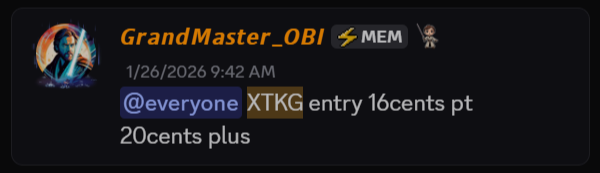

XTKG — X3 Holdings

- Alerted: Jan 26, 2026 at $0.16

- High: Jan 26–27, 2026 at $0.55–$0.61

- Gain: ~+240% to +280%

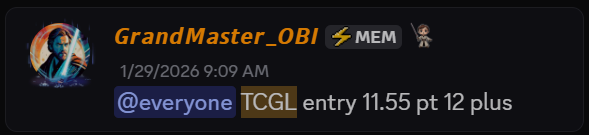

TCGL — TechCreate Group

- Alerted: Jan 29, 2026 at ~$11.55

- Peak: Jan 29, 2026 at $457.64

- Gain: ~+3,800%

(Later suspended by regulators — no allegation tied to any specific trader or community.)

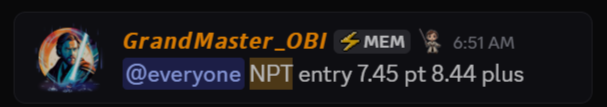

NPT — Texxon Holding

- Alerted: Feb 3, 2026 at $7.45

- High: Feb 3, 2026 at $30.21

- Gain: ~+306%

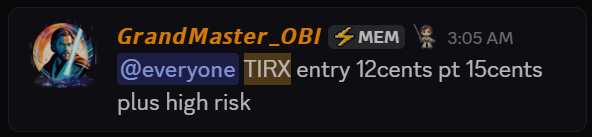

TIRX — Tian Ruixiang

- Alerted: Feb 3, 2026 at $0.12

- High: Feb 3, 2026 at $0.29

- Gain: ~+142%

The Controversial Question Traders Are Asking

At what point does this stop being “luck” and start looking like a repeatable system?

That’s where the tension is coming from.

Market veterans aren’t rattled by one big trade.

They get uneasy when patterns emerge — especially in low-float names where retail participation alone can reshape price discovery.

This isn’t one viral thesis.

It’s multiple alerts, across weeks, with similar structure:

- early entries

- thin liquidity

- fast crowd response

- outsized percentage moves

That combination is exactly what institutions can’t front-run easily.

Why People Are Rushing to Join the Discord

The argument from traders inside the Making Easy Money Discord is simple:

“You don’t join for the spike — you join to be early.”

LIMN is now being used as the latest proof point:

- If you chased it at $1.50, your risk was massive

- If you saw it near $0.80, you had flexibility

That gap — early vs late — is the entire business model of modern retail momentum.

Making Easy Money Discord will close at 25K members.

— MEM OBI (@ObiMem) February 3, 2026

We’re already near 18K and expect to reach capacity in 30 days or less.

Once full, new members will not be accepted. 🔒

Join before the cutoff.#StockMarketToday #FinanceNews #GME $GME $AMC https://t.co/xK8WWIjUQK

Why This Is Becoming a Bigger Story

LIMN continuing into February 4 changed the narrative.

Now it’s not:

- “He caught another mover”

It’s:

- “How many of these happen before this becomes impossible to ignore?”

That’s why criticism is getting louder, why skeptics are suddenly watching alerts instead of dismissing them, and why the community keeps growing despite controversy.

Bottom Line

LIMN’s run from $0.80 (Feb 3) to $2.10 (Feb 4) didn’t just reward early traders — it reignited the debate.

Is this just a hot streak?

Or is retail trading entering another phase where speed, coordination, and early visibility matter more than ever?

Either way, one thing is clear:

Traders aren’t watching these moves after they happen anymore.

They’re trying to be where the next alert starts.

And that’s exactly why LIMN is still running — and why the conversation isn’t cooling off anytime soon.