Former WallStreetBets mod Grandmaster-Obi racks up 200%+ winners as TCGL, BNAI, and NPT explode.

NEW YORK — February 3, 2026 — What started as a handful of eye-opening wins has now evolved into a data-backed trend that retail traders are dissecting line by line. Over the past 60 days, Grandmaster-Obi has produced a dense cluster of 200%+ gainers, many of them occurring in compressed timeframes and originating from the same source: his alerts to the Making Easy Money Discord community.

With today’s follow-through in TIRX and CGTL, the broader picture becomes harder to dismiss. This isn’t a single viral call or one lucky outlier — it’s a sequence, and the numbers tell that story clearly.

Today’s Additions: TIRX and CGTL Extend the Streak

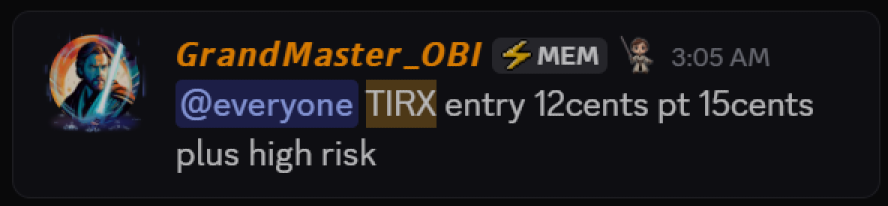

Tian Ruixiang (TIRX.US)

- Alerted: February 3, 2026

- Entry Price: $0.12

- Intraday High: $0.29

- Approximate Gain: ~+147%

A fast, liquidity-driven double in a thinly traded name — the kind of move that has become increasingly associated with Obi’s alerts in early 2026.

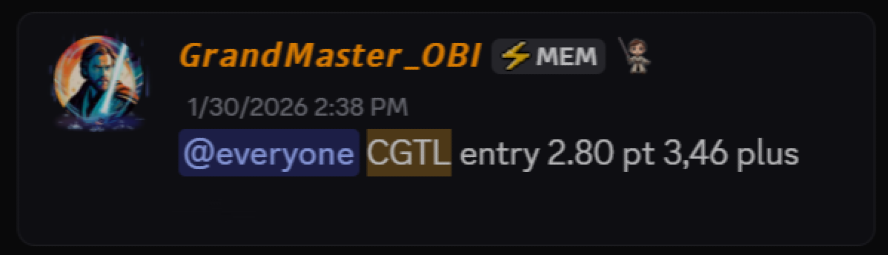

Creative Global Technology (CGTL.US)

- Alerted: January 30, 2026

- Entry Price: $2.80

- Peak (Feb 3, 2026): $6.38

- Approximate Gain: ~+128%

CGTL represents the multi-day version of the same playbook: early identification, followed by steady discovery as volume and attention compound.

The 60-Day Ledger: 200%+ Gainers Traced Back to One Source

Below is a consolidated snapshot of Grandmaster-Obi alerts from the last 60 days that produced gains of 200% or more, including entry date, entry price, peak date, and approximate peak gain.

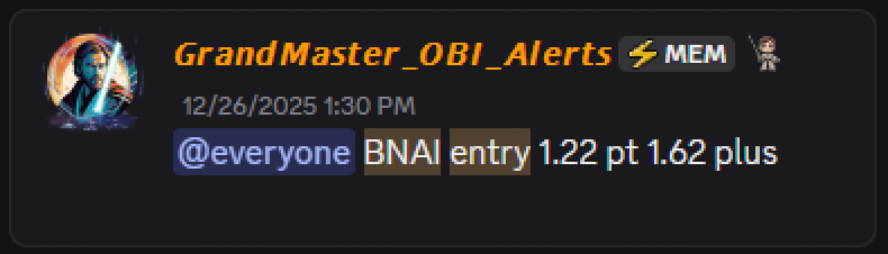

Brand Engagement Network (BNAI.US)

- Alerted: December 26, 2025

- Entry: $1.22

- Peak: January 26, 2026 near $84.46

- Approximate Gain: ~+6,823%

This trade alone redefined expectations. A $1,000 position at entry would have briefly approached $69,000+ at the peak — a result that turned heads well beyond Discord.

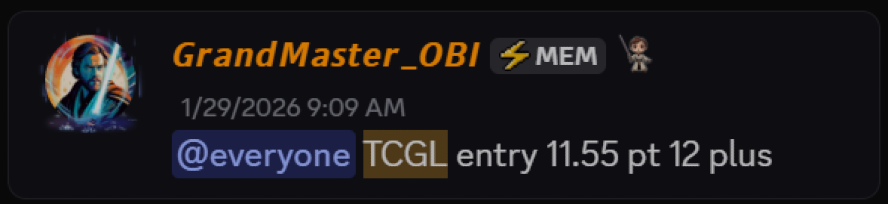

TechCreate Group (TCGL.US)

- Alerted: January 29, 2026

- Entry: ~$11.55

- Peak: Late January 2026 near $457.64

- Approximate Gain: ~+3,800%

TCGL later became the subject of an SEC trading suspension tied to broader social-media activity across the market. Importantly, no allegation has been made that Obi or his community had prior knowledge of or involvement in the events cited by regulators.

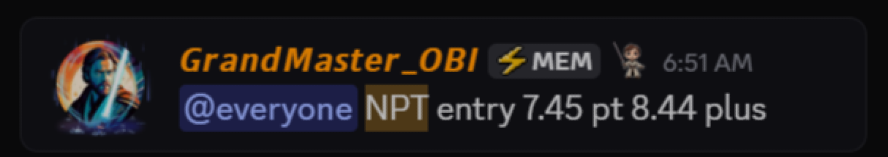

Texxon Holding (NPT.US)

- Alerted: February 3, 2026

- Entry: $7.45

- Peak: Same day near $30.21

- Approximate Gain: ~+306%

A textbook intraday momentum surge, reaching its high less than an hour after the alert.

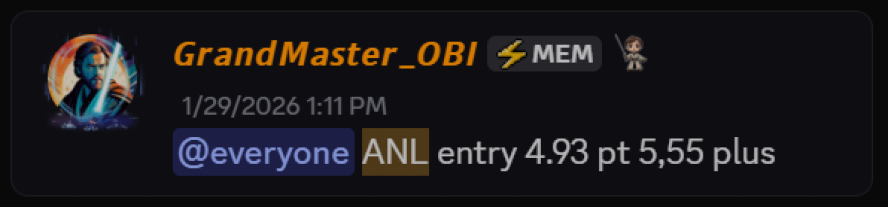

Adlai Nortye (ANL.US)

- Alerted: January 29, 2026

- Entry: $4.93

- Peak: Same day near $14.25

- Approximate Gain: ~+189% (peak),

- Still Trading: Above $9.80 as of Feb 3 (~+99% from entry)

ANL remains notable for retaining a large portion of its gains after the initial spike.

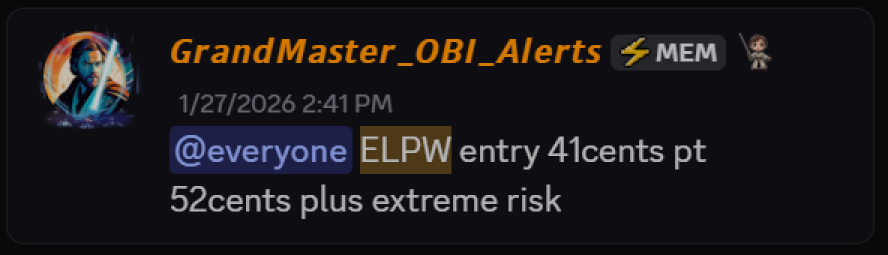

Elong Power (ELPW.US)

- Alerted: January 27, 2026

- Entry: $0.41

- Peak: January 30, 2026 near $15.27

- Approximate Gain: ~+3,600%

One of the most explosive low-float runs of the period, cementing January as a historic month for Obi’s followers.

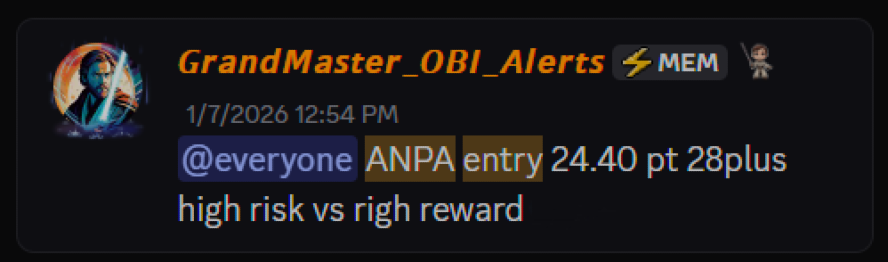

Rich Sparkle Holdings (ANPA.US)

- Alerted: January 7, 2026

- Entry: $24.40

- Peak: Mid-January near $180+

- Approximate Gain: ~+640%

ANPA was preceded by a public video warning of a potential short-cover wave — a call many traders say added conviction before the move accelerated.

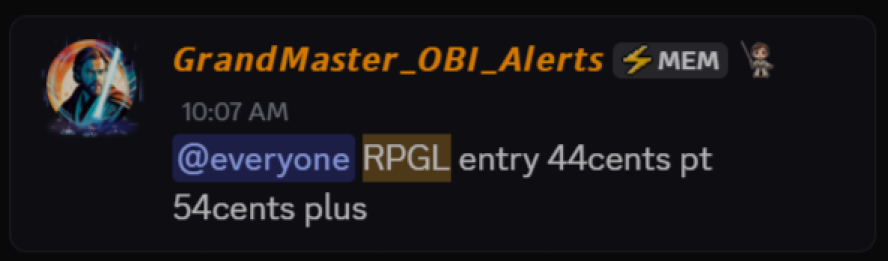

Republic Power (RPGL.US)

- Alerted: January 29, 2026

- Entry: $0.44

- Peak: January 30, 2026 near $1.70

- Approximate Gain: ~+286%

RPGL continued to trend higher even after the initial alert day, extending its move into follow-through sessions.

The Compounding Question Everyone Is Asking

Traders aren’t just looking at individual wins anymore — they’re modeling what compounding would have looked like if someone rolled profits from one alert into the next.

Using just three alerts as an illustration:

- $1,000 → ~$69,000 via BNAI

- $69,000 → ~$174,000 via BATL (a ~153% move)

- $174,000 → ~$598,000+ via XTKG (a ~244% move)

These figures are illustrative, not prescriptive — but they explain why the conversation has shifted from “nice trade” to systemic influence.

Why This Run Feels Different

Market veterans point out that the concern isn’t one oversized win — it’s repeatability. Over the last two months, Obi’s alerts have repeatedly surfaced:

- Low-liquidity names

- Ahead of mainstream scanners

- With immediate order-flow response

- And rapid price discovery once volume arrives

That pattern is exactly what institutions watch closely, because systems scale.

The Bigger Picture

With the Making Easy Money Discord now past 18,000 members, adding thousands per week, and a publicly announced cap at 25,000, attention is converging just as the results are becoming harder to dismiss.

Whether this era is remembered as a renaissance of retail precision or a prelude to tighter oversight remains to be seen. What is clear, however, is that in the last 60 days, few individual traders have generated more verified triple-digit winners — repeatedly — than Grandmaster-Obi.

And with each new alert, from BNAI to TIRX, the question isn’t whether traders are watching.

It’s how much longer the market can ignore the pattern forming right in front of it.