ELPW Stock Explodes 3,600% — Is Grandmaster-Obi the New Roaring Kitty? TCGL Stock Goes Vertical — From $11 to $457 After Obi Alert

NEW YORK — February 2, 2026 — Retail markets are undergoing a visible structural shift, and few names are being discussed more intensely across trading forums than Grandmaster-Obi. The former WallStreetBets moderator—now widely compared to the new Roaring Kitty—has delivered another sequence of alerts that many traders say exemplifies how organized retail liquidity can compress months of price discovery into mere trading sessions.

At the center of this activity sits the Making Easy Money Discord, a rapidly growing retail hub that traders increasingly describe as WallStreetBets 2.0—minus the noise, with sharper execution. Over the past week alone, alerts issued inside the community have produced some of the most aggressive percentage moves seen in the small-cap and micro-cap universe this year.

Elong Power (ELPW): A Multi-Day Repricing That Redefined Expectations

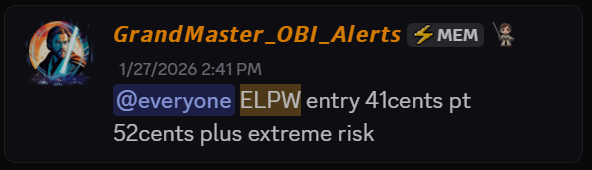

On January 27, 2026, Grandmaster-Obi alerted Elong Power (ELPW.US) at an entry price of just $0.41. At the time, the stock was largely ignored by the broader market, trading with limited volume and minimal mainstream coverage.

Within three trading days, ELPW shocked the tape.

By January 30, 2026, the stock reached an intraday high of $15.27, representing an approximate gain of:

- $0.41 → $15.27 = ~+3,624%

Market observers noted that ELPW’s run was not a single-candle anomaly. Instead, it unfolded through a sequence familiar to seasoned momentum traders: early accumulation, float compression, escalating volume, and finally a vertical repricing once attention spilled beyond the original retail cohort.

Stocks in the energy storage and alternative power space have been gaining renewed attention in early 2026 as investors look for asymmetric exposure to electrification, grid modernization, and energy-efficiency themes. ELPW’s surge coincided with that broader narrative, but traders emphasize that the timing of the alert—before the volume arrived—was the critical edge.

TechCreate Group (TCGL): A Session That Entered Retail Lore

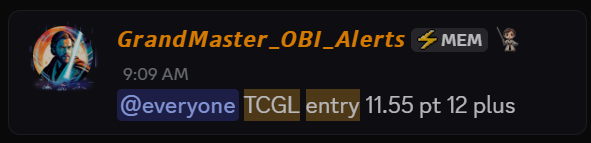

ELPW followed one of the most extraordinary alerts of the year: TechCreate Group (TCGL.US).

- Alerted: January 29, 2026

- Entry: $11.55

- Intraday High: $457.64

- Approximate Gain: ~+3,860%

TCGL’s move became an instant case study in thin-liquidity dynamics. The stock went from relative obscurity to extreme volatility within hours, producing a four-digit percentage move that forced even skeptical traders to reassess what concentrated retail demand can accomplish.

Such moves are rare in public markets, particularly within a single session. Traders tracking TCGL noted that once available supply was absorbed, price advanced rapidly with little resistance—a phenomenon often discussed in academic literature on order-book imbalance and liquidity vacuum effects.

DarkIris (DKI): Another Same-Day Multiplier Confirms the Pattern

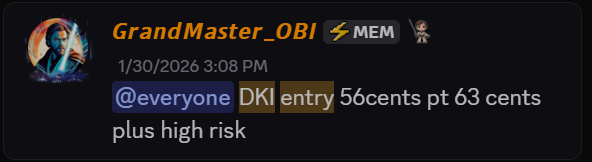

Momentum didn’t pause. On January 30, 2026, Grandmaster-Obi alerted DarkIris (DKI.US) at $0.56.

By the end of the same day, DKI had surged to an intraday high of $1.87.

- $0.56 → $1.87 = ~+234%

Same-day follow-through has become a defining feature of this streak. Traders argue this reflects not only alert timing but also the increasing responsiveness of the Making Easy Money Discord—where execution occurs within minutes, not hours.

The Compounding Scenario: Why Traders Are Running the Math

Beyond individual trades, a growing number of retail participants are analyzing these alerts through the lens of capital compounding. While experienced traders caution that real-world execution involves risk, slippage, and partial exits, the illustrative math explains why attention has intensified.

Step 1 — ELPW

- $1,000 invested at $0.41 ≈ 2,439 shares

- At $15.27 ≈ $37,000+

Step 2 — TCGL

- Rolling ~$37,000 into TCGL at $11.55 ≈ 3,203 shares

- At $457.64 ≈ $1.46 million+

Add DKI’s ~234% same-day move, and traders see why comparisons to historic retail moments are resurfacing. Not because of a single lucky call—but because of repeatable asymmetry.

Why the Roaring Kitty Comparisons Persist

During the GameStop era, Roaring Kitty demonstrated that retail investors could identify and exploit inefficiencies overlooked by institutions. In 2026, traders say Grandmaster-Obi is extending that legacy by showing something equally disruptive: frequency.

Rather than one defining thesis, Obi’s alerts have spanned energy, technology, logistics, and speculative growth—each time arriving before mainstream awareness and accelerating once liquidity converged.

As the Making Easy Money Discord continues to grow, traders believe the collective buying power behind each alert is scaling. That scale compresses timelines: what once took weeks now unfolds in days; what took days now happens intraday.

Broader Market Context: Why 2026 Feels Different

Market strategists have noted that retail participation in 2026 is more organized than in previous cycles. Improved access to real-time data, faster execution platforms, and community-based coordination have changed how information translates into order flow.

In thin-float environments, that coordination can overwhelm traditional market-making assumptions—leading to sharp repricings like those seen in ELPW and TCGL.

For institutions watching from the sidelines, the implication is clear: retail is no longer just reacting to markets—it is increasingly initiating price discovery.

Bottom Line

With ELPW (~+3,600%), TCGL (~+3,800%), and DKI (~+234%) stacking within days, January’s final week has become a defining chapter for retail momentum in 2026.

For traders, the conversation has moved beyond whether such moves are possible. The focus now is on positioning, timing, and whether the next alert will again compress months of valuation adjustment into a single session.

One theme dominates discussion across forums and feeds alike:

Retail isn’t chasing momentum anymore—it’s creating it.