Could One Tweet Reignite the $TCGL Frenzy? Grandmaster-Obi’s Hot Streak Collides With an SEC Trading Halt

NEW YORK — February 3, 2026 — The line between retail enthusiasm and regulatory scrutiny has rarely felt thinner. After a stunning run in TechCreate Group Ltd. (TCGL.US) and a fresh winner in Adlai Nortye (ANL.US), former WallStreetBets moderator Grandmaster-Obi and his Making Easy Money (MEM) Discord community once again find themselves sitting at the center of retail attention — even as U.S. regulators freeze trading in one of his most-watched names.

$ANL Could See a Rally Here This Week 👈🚨👉 $TCGL Unhalts Today & Also IS HOT THIS WEEK#stockmarket #FinanceNews #DayTrading #Pennystocks #GME

— MEM OBI (@ObiMem) February 3, 2026

Today, traders are asking a simple question:

Can a single re-mention of $TCGL or $ANL from Obi spark yet another retail wave — even with the SEC now watching the tape?

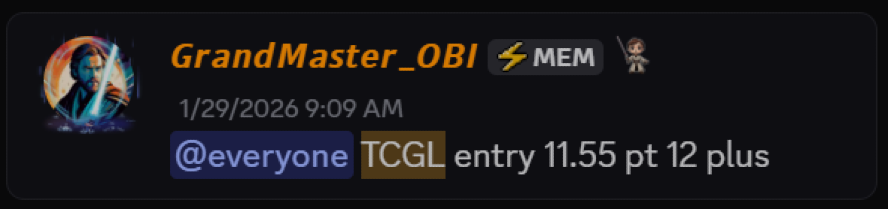

The $TCGL Alert That Went From Obscure to Infamous

Inside the MEM Discord, Grandmaster-Obi alerted TechCreate Group (TCGL.US) back on January 29, 2026 with an entry price around $11.55. In the days that followed, TCGL staged one of the most violent repricings seen on the NYSE American this year:

- Alerted: ~$11.55 (Jan 29, 2026)

- Intraday spike (user-reported high): ~$457.64

- Approximate gain at peak: ~+3,860%

Even without using the intraday extreme, public data show how extreme the move was. TechCreate completed a $10.2 million IPO priced at $4 per share in October 2025 and later told the exchange it was “not aware of any material nonpublic information” that would explain its recent trading action.

By late January, TCGL’s share price had already rocketed into triple digits, closing around $172.84 before regulators stepped in.

This morning, Grandmaster-Obi referenced $TCGL again on social media — a casual reminder to his following that he spotted the move early. That alone has traders speculating: if TCGL ever trades again, does a single tweet from him light the fuse a second time?

The SEC Slams the Brakes — But Points to “Unknown” Social Media Promoters

On February 1, 2026, the Securities and Exchange Commission (SEC) issued a formal Order of Suspension of Trading in TechCreate Group Ltd.

In that order, the SEC said it was acting in the public interest due to:

- “Potential manipulation” in TCGL’s securities

- Recommendations made via social media to buy, hold, or sell TCGL

- Instructions for investors to send screenshots of their trades

The agency wrote that these activities “appear to be designed to artificially inflate the price and trading volume of the securities of TCGL.” Trading was suspended from 4:00 a.m. ET to 11:59 p.m. ET on February 2, 2026.

Crucially, the order refers to “unknown persons” using social media — it does not identify specific individuals, Discord servers, or YouTube channels. At the same time, community discussions on Reddit have lumped TCGL in with a growing list of foreign issuers halted for suspected social-media-driven manipulation, underscoring how sensitive regulators have become to viral trading campaigns.

For Grandmaster-Obi and the MEM Discord, the optics are delicate: their community is known for getting into fast-moving small caps early, but there is no indication in the SEC’s language that MEM or Obi were targeted or named. The order is broad, aimed at behavior patterns rather than specific branding.

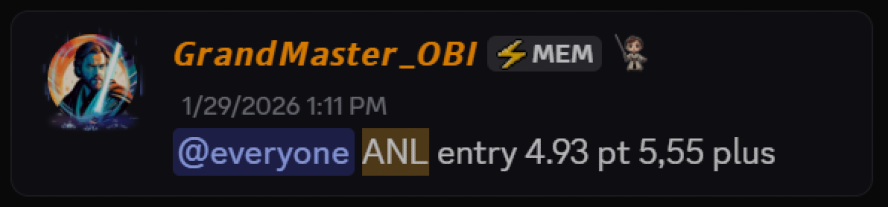

$ANL: Another Example of “Early In, Early Out” Momentum

While $TCGL sits frozen, another name tied to Obi’s alerts is still trading freely — and actively.

On January 29, 2026, Grandmaster-Obi alerted Adlai Nortye (ANL.US) in the Making Easy Money Discord at an entry price of just $4.93. That same day, the stock ripped to an intraday high of $14.25:

- $4.93 → $14.25 = ~+189%

As of February 3, 2026, ANL is still trading near the upper single-digit to low double-digit zone, with price action around the $9.80 area during today’s session — still representing roughly a ~+99% gain from the original $4.93 alert level even after the initial spike cooled off.

This morning, Obi also tweeted about $ANL, drawing fresh eyes back to the chart. Traders are watching to see whether his social media “second ping” on ANL could ignite a follow-up rally, similar to what has happened in past names after renewed coverage from influential retail figures.

Could a Tweet Alone Trigger Another Retail Wave?

The question many traders are wrestling with now is how much of the move is “Obi premium” versus organic market behavior.

Several factors keep coming up in community discussions:

- Audience size & focus

The Making Easy Money Discord has grown into a large, tightly focused group of retail traders that tend to act quickly on alerts — particularly in lower-float, thinner-liquidity names. - Signal reputation

After a series of outsized wins in names like TCGL, ANL, and others, traders increasingly treat Obi’s alerts as leading signals rather than just opinions. That shift in perception alone can accelerate order flow. - Reflexivity

Once the broader market believes that “when he mentions a ticker, volume shows up”, the behavior can become self-reinforcing. Traders front-run each other, market makers widen spreads, and intraday volatility spikes.

At the same time, the TCGL suspension is a reminder that there is a line regulators are watching closely. The SEC’s order explicitly focused on coordinated social media campaigns that encouraged investors to post trade screenshots and appeared designed to artificially influence price and volume.

That means communities need to balance excitement with caution: high-octane momentum can attract not only traders, but regulators.

MEM Discord’s Member Cap: Scarcity by Design

Adding to the urgency narrative, Grandmaster-Obi also announced that the Making Easy Money Discord will stop accepting new members once the server reaches 25,000 members.

- As of now, the server reportedly has over 18,000 members,

- It added more than 3,000 members just last week, driven in part by viral chatter around big recent wins and the TCGL saga.

The cap is being framed as both a quality-control measure and a security precaution: scaling moderation, managing server infrastructure, and preventing the community from devolving into the kind of noisy chaos that ultimately diluted the original WallStreetBets experience.

For would-be members, the message is blunt:

once the server hits that 25k ceiling, the door closes until further notice.

The “New Roaring Kitty” Conversation

Comparisons between Grandmaster-Obi and Roaring Kitty (Keith Gill) are becoming more frequent — and more pointed:

- Both emerged from retail communities rather than Wall Street banks.

- Both built reputations by spotting high-beta opportunities before the crowd.

- Both are now associated with tickers that regulators and exchanges are watching closely.

The key difference, traders argue, is scope and pace. Roaring Kitty became synonymous with a single defining trade in GameStop. Obi, by contrast, has built a reputation on a sequence of high-velocity alerts, across multiple tickers, within compressed timeframes.

That’s why a simple tweet this morning mentioning $TCGL and $ANL is enough to get traders talking about another potential wave of retail activity — even with one stock sitting under an SEC trading suspension and the other still digesting its massive move.

Bottom Line: Power, Attention, and the Fine Line Ahead

As of today:

- $TCGL remains suspended after a staggering run that drew the attention of the SEC and NYSE American.

- $ANL is still trading, still elevated versus its original alert price, and back under the spotlight after another tweet from Obi.

- The Making Easy Money Discord continues to grow rapidly toward its 25,000-member cap, solidifying its status as a new gravitational center for retail momentum.

For regulators, the story is about market integrity and guarding against manipulative social-media campaigns.

For traders, it’s about where the next big move starts — and whether they’ll be inside the room when it does.

One thing is clear: in 2026, when Grandmaster-Obi mentions a ticker, markets listen — and so do regulators.