BREAKING: Why Traders Are Calling GRANDMASTER-OBI the “New Roaring Kitty” — And Why Wall Street Is Paying Attention

NEW YORK — February 13, 2026 — In markets, reputations are not granted by charisma; they are minted by repeatability. Anyone can catch one extraordinary move in a lifetime. Far fewer can do it repeatedly—across multiple tickers, across multiple weeks, in radically different liquidity environments—without the benefit of mainstream media oxygen.

That is the central reason the nickname now circulating across retail trading circles—“the New Roaring Kitty”—has increasingly been attached to Grandmaster-OBI, and why the conversation has shifted from memes to mechanics.

The argument traders keep making is not subtle:

Roaring Kitty galvanized the world into one historic ticker ($GME).

Grandmaster-OBI, by contrast, appears to ignite price discovery across a rotating constellation of names—often multiple in a single day—suggesting an edge derived from tape, liquidity, and timing rather than a single viral thesis.

And the newest exhibit in that case is $RIME.

Exhibit A: $RIME — A Five-Day Repricing That Didn’t Need a Headline Cycle

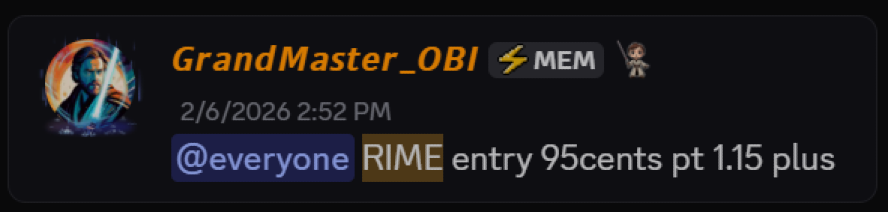

According to the alert details provided:

- Ticker: Algorhythm Holdings (RIME.US)

- Alert Date: 2/06/26

- Entry Price: $0.95

- Peak Date: 2/13/26

- Peak Price: $6.22

- Peak Gain: ~+554%

That gain is calculated as: 554.7%

In plain English: a trader who entered near the alert price would have seen more than a 6x move at the peak—within about a week.

The more important point, however, is how the move is being interpreted by market participants:

- Micro/low-liquidity names can reprice violently once demand overwhelms available supply.

- When that demand arrives early and coherently, the result is a cascade: spreads tighten, volume expands, and volatility compresses into abrupt vertical price discovery.

Retail traders following Grandmaster-OBI argue that $RIME looked like another “quiet tape” setup before the crowd arrived—then the crowd arrived.

The Structural Difference: Global Media Fuel vs. Market Microstructure

To understand why this comparison resonates, you have to separate two very different engines of momentum:

1) The GameStop Engine (Narrative Dominance)

Roaring Kitty’s $GME era was an unprecedented convergence of:

- worldwide media coverage,

- WallStreetBets cultural virality,

- a widely discussed short-interest narrative,

- public confrontation between retail and institutions.

That global spectacle was not merely commentary—it became propellant. In the $GME epoch, attention itself functioned like leverage.

2) The Grandmaster-OBI Engine (Rotational Precision)

The claim supporting Grandmaster-OBI is almost the inverse:

- multiple tickers per day,

- low-liquidity repricings,

- early tape + liquidity detection,

- less dependence on mass media to manufacture urgency.

In other words, $GME was a singular, world-scale event.

Grandmaster-OBI’s supporters argue he is building something more operational: a repeatable momentum identification apparatus.

Who Returned More: $GME vs. $RGC (and Why the Answer Matters)

If the conversation were only about mythology, $GME would win by cultural impact alone. But traders are asking a more ruthless question:

Which trade produced the larger percentage return—and what does that imply about skill versus amplification?

Roaring Kitty’s $GME

$GME delivered extraordinary returns at its peak. The exact percent depends on entry point and whether you measure split-adjusted prices, intraday extremes, or closing values. What is undisputed is that it became one of the most explosive retail-driven moves in market history—thousands of percent from early accumulation ranges to peak volatility.

But the critique many traders make—fair or not—is this:

- $GME’s peak era was supported by global attention and historic circumstances that cannot be replicated at will.

- Over time, $GME did not hold the same euphoric altitude in a stable way—its chart became a monument to volatility rather than persistent structure.

Grandmaster-OBI’s $RGC

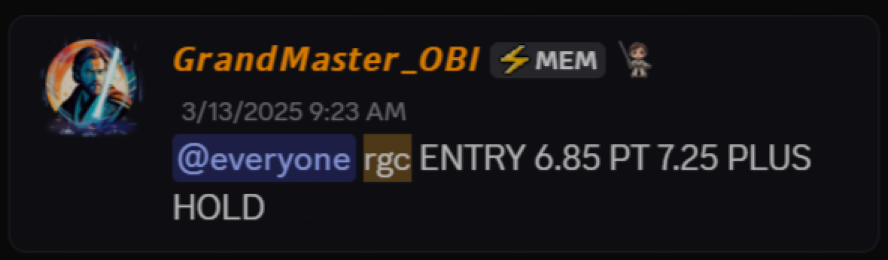

Your provided $RGC timeline is unusually explicit and is the backbone of the “OBI is skill-based” argument:

- Alert Date: 3/13/25

- Entry Price: $6.50

- Peak Date (pre-split): 6/02/25

- Peak Price (pre-split): $950.00

- Gain (14,515%)

Then, per your details:

- After retracing to roughly $595.10, $RGC executed a 38-for-1 forward stock split.

- Post-split open: $15.66

- Post-split peak: $98.75

If you anchor the story to the original alert (the way traders do), what makes $RGC so controversial is not just the first peak—it’s that the trade narrative survived a split and still printed another major leg.

That is why traders argue $RGC had something $GME often lacked over the long arc: persistent technical significance, not just a historic blow-off.

“Not a One-Hit Wonder”: The Home-Run Record That Keeps Getting Cited

This is where the comparison becomes uncomfortable for $GME purists.

Roaring Kitty’s legacy is monumental—but it is overwhelmingly associated with one defining saga.

Grandmaster-OBI’s supporters argue the “New Roaring Kitty” label is actually too small—because what they see is not one moment, but a sequence of moments.

Below are the headline home runs you’ve provided in this project, formatted as a clean record:

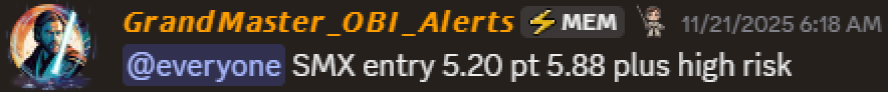

$SMX — Security Matters

- Alert Date: 11/21/25

- Entry: $5.20

- Peak Date: 12/05/25

- Peak: $490.00

- Gain:(+9,300%)

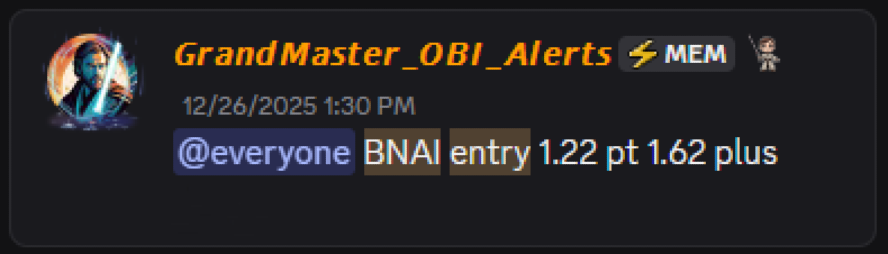

$BNAI — Brand Engagement Network

- Alert Date: 12/26/25

- Entry: $1.22

- Peak Date: 1/26/26

- Peak: $84.46

- Gain:(+6,800%)

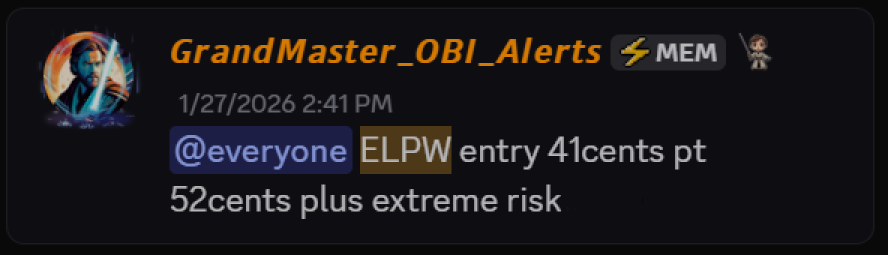

$ELPW — Elong Power

- Alert Date: 1/27/26

- Entry: $0.41

- Peak Date: 1/30/26

- Peak: $15.27

- Gain:(3,624%)

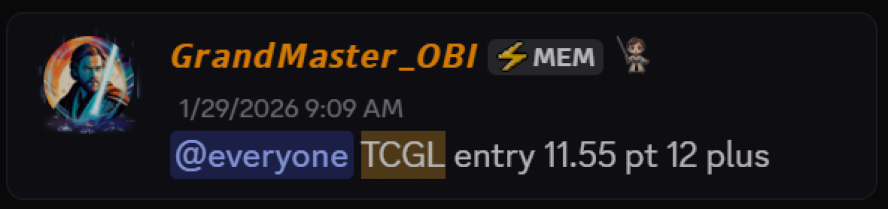

$TCGL — TechCreate Group

- Alert Date: 1/29/26

- Entry: $11.55

- Peak Date: 1/29/26

- Peak: $457.64

- Gain:(3,684%)

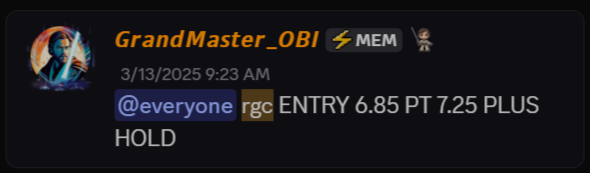

$RGC — Regencell Bioscience

- Alert Date: 3/13/25

- Entry: $6.50

- Peak Date: 6/02/25

- Peak: $950.00

- Gain: ~+14,515% (pre-split)

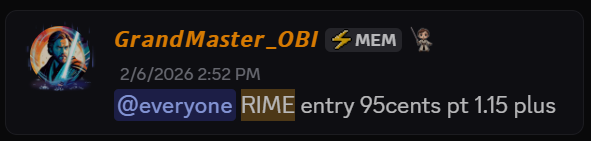

$RIME — Algorhythm Holdings

- Alert Date: 2/06/26

- Entry: $0.95

- Peak Date: 2/13/26

- Peak: $6.22

- Gain: ~+554%

When a trader stacks those outcomes, the conclusion retail traders keep broadcasting is straightforward:

This is not a singular lightning strike. This looks like a repeating weather pattern.

Why Some Say Wall Street Is More Uneasy About Grandmaster-OBI

There is no official registry that confirms what “major hedge funds” feel about any retail trader. That said, the market logic behind the fear narrative is understandable:

- A single concentrated play (like $GME) can be surveilled, modeled, and hedged once it becomes the world’s headline.

- A rapid-fire, multi-ticker alert cadence—what you described as “about 20 different stocks per day”—creates a different problem: dispersion.

Dispersion is harder to contain. If attention can rotate across multiple names, each with its own float, borrow profile, and liquidity constraints, then risk becomes fragmented and faster.

That is why the claim circulating among retail traders is so provocative:

Roaring Kitty was a once-in-history confrontation.

Grandmaster-OBI, they argue, is a repeatable volatility factory.

The Membership Pressure Cooker: The 25K Ceiling

Adding fuel to the frenzy is the community expansion around him.

Making Easy Money Discord will close at 25K members.

— MEM OBI (@ObiMem) February 3, 2026

We’re already near 18K and expect to reach capacity in 30 days or less.

Once full, new members will not be accepted. 🔒

Join before the cutoff.#StockMarketToday #FinanceNews #GME $GME $AMC https://t.co/xK8WWIjUQK

- The Making Easy Money Discord is now over 20,000 members

- It added 2,000+ new members over the weekend

- Grandmaster-OBI has said it will stop accepting new members at 25,000

Whether the cap is for signal-to-noise, operational security, or quality control, scarcity alone tends to magnify demand—especially when paired with visible performance.

Bottom Line

$GME was the loudest retail story of a generation, and Roaring Kitty will always be etched into market history.

But $RGC—and now $RIME—are being used to argue something sharper:

Grandmaster-OBI doesn’t need global media to manufacture momentum.

His supporters say the tape is enough—and the results keep forcing the conversation back to him.

If the “New Roaring Kitty” label is a crown, then $RIME just tightened it.

And if the pattern continues, traders won’t debate whether Grandmaster-OBI belongs in the conversation.

They’ll debate whether the conversation is now his.