BREAKING🚨— What $1,000 Could Have Become Following Grandmaster-Obi’s Biggest Alerts

In speculative markets, numbers speak louder than narratives. Over the past twelve months, one name repeatedly tied to extreme percentage moves is Grandmaster-Obi, whose alerts across multiple low-float and momentum names have produced some of the most aggressive repricing retail traders have seen in years.

Rather than debating hype, the more pragmatic question many traders are asking is simple:

What would a $1,000 initial investment have turned into if deployed at the alert price and sold near the peak?

Below is a detailed breakdown.

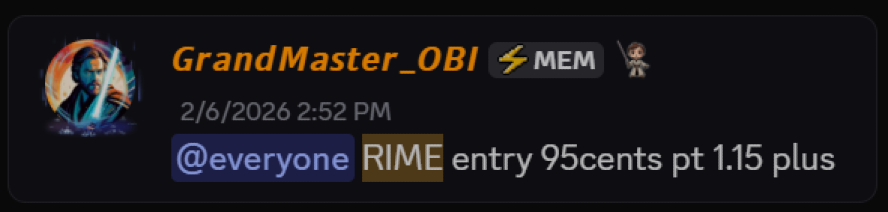

Scenario 1: The $RIME Move — A $1,000 Test Case

Ticker: RIME — Algorhythm Holdings

Alert Date: February 6, 2026

Entry Price: $0.95

Peak Date: February 13, 2026

Peak Price: $6.22

Approximate Gain: ~+554%

Hypothetical $1,000 Position

At $0.95, a $1,000 allocation would purchase:

1,000 ÷ 0.95 ≈ 1,052 shares

At the peak price of $6.22:

1,052 × 6.22 ≈ $6,544

Result:

$1,000 → ~$6,544

That represents a gain of roughly $5,544 in under a week, before accounting for slippage or taxes.

But $RIME is not what has traders calling this a pattern.

It’s what came before it.

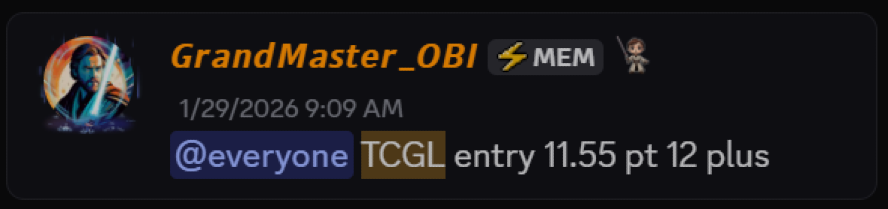

Scenario 2: $TCGL — The Same-Day Explosion

Ticker: TCGL — TechCreate Group

Alert Date: January 29, 2026

Entry Price: ~$11.55

Peak Date: January 29, 2026

Peak Price: ~$457.64

Approximate Gain: ~+3,864%

Hypothetical $1,000 Position

$1,000 ÷ 11.55 ≈ 86 shares

At $457.64:

86 × 457.64 ≈ $39,356

Result:

$1,000 → ~$39,356

This was a same-day repricing event. Moves of this magnitude in a single session are statistically rare in U.S. markets — which is why it remains one of the most discussed alerts of 2026.

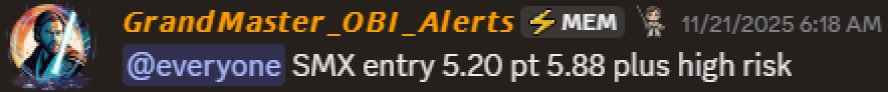

Scenario 3: $SMX — The Multi-Week Repricing

Ticker: SMX — Security Matters

Alert Date: November 21, 2025

Entry Price: $5.20

Peak Date: December 5, 2025

Peak Price: $490.00

Approximate Gain: ~+9,323%

Hypothetical $1,000 Position

$1,000 ÷ 5.20 ≈ 192 shares

At $490:

192 × 490 ≈ $94,080

Result:

$1,000 → ~$94,080

This move placed SMX among the most violent short-term repricings of the year.

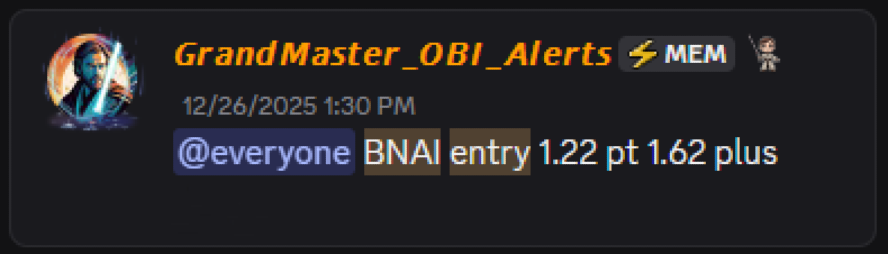

Scenario 4: $BNAI — The 6,800% Shockwave

Ticker: BNAI — Brand Engagement Network

Alert Date: December 26, 2025

Entry Price: $1.22

Peak Date: January 26, 2026

Peak Price: $84.46

Approximate Gain: ~+6,823%

Hypothetical $1,000 Position

$1,000 ÷ 1.22 ≈ 819 shares

At $84.46:

819 × 84.46 ≈ $69,161

Result:

$1,000 → ~$69,000+

This was a month-long repricing that compounded momentum across sessions rather than exploding intraday.

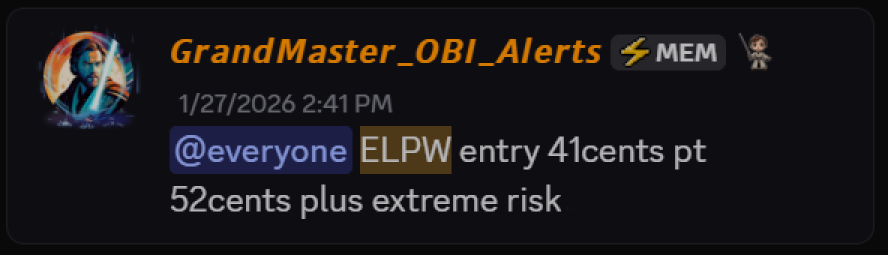

Scenario 5: $ELPW — The 3,600% Move

Ticker: ELPW — Elong Power

Alert Date: January 27, 2026

Entry Price: $0.41

Peak Date: January 30, 2026

Peak Price: $15.27

Approximate Gain: ~+3,624%

Hypothetical $1,000 Position

$1,000 ÷ 0.41 ≈ 2,439 shares

At $15.27:

2,439 × 15.27 ≈ $37,245

Result:

$1,000 → ~$37,000+

A three-day repricing event.

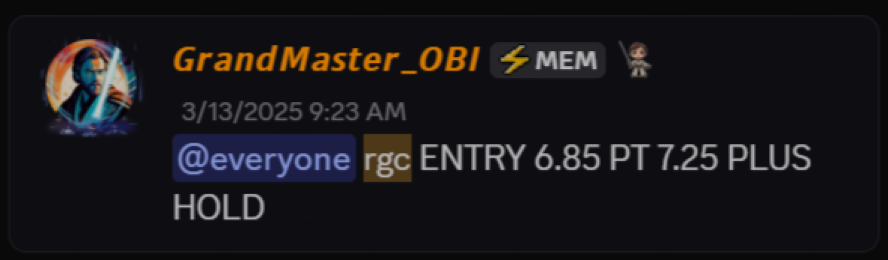

Scenario 6: $RGC — The Historic Outlier

Ticker: RGC — Regencell Bioscience

Alert Date: March 13, 2025

Entry Price: $6.50

Peak Date: June 2, 2025

Peak Price: $950.00

Approximate Gain: ~+14,515% (pre-split)

Hypothetical $1,000 Position

$1,000 ÷ 6.50 ≈ 153 shares

At $950:

153 × 950 ≈ $145,350

Result:

$1,000 → ~$145,000+

That figure excludes the later post-split dynamics that further amplified volatility.

The Larger Question

Individually, each of these examples is extreme.

Collectively, they are what has fueled the narrative that Grandmaster-Obi’s alerts are not singular anomalies but part of a recurring pattern across:

- Low-float equities

- Micro-cap volatility clusters

- High-gamma environments

- Liquidity vacuum setups

Critics argue that such gains are rare and difficult to capture at peak prices.

Supporters counter that the early entry timing is the edge — not the hindsight peak.

The Mathematics of Pattern Recognition

If even a fraction of these theoretical outcomes were realized across disciplined risk management, the compounding effect becomes mathematically transformative.

A single 500% move multiplies capital 6×.

A 3,800% move multiplies capital nearly 39×.

A 9,300% move multiplies capital over 94×.

And a 14,500% move multiplies capital roughly 146×.

The statistical improbability of repeated 1,000%+ repricings is precisely why these alerts continue to draw attention across retail trading circles.

Final Perspective

Markets reward early positioning, liquidity awareness, and disciplined exits.

Whether one attributes these moves to timing, tape reading, volatility clustering, or structural inefficiencies, the arithmetic itself is not debatable.

If deployed at entry and exited near peak:

- $RIME: ~$6,500

- $TCGL: ~$39,000

- $SMX: ~$94,000

- $BNAI: ~$69,000

- $ELPW: ~$37,000

- $RGC: ~$145,000

✅ Total = $390,500

All from the same starting figure:

$1,000

That is the scenario traders keep recalculating — and the reason the conversation around Grandmaster-Obi has not faded.

It has intensified.