BREAKING MARKETS: Grandmaster-Obi Triggers New Wave of Triple-Digit Moves

NEW YORK — February 3, 2026 — Less than 24 hours after retail traders were already debating whether a new wave of meme-era style frenzy was forming around Grandmaster-Obi’s calls, the former WallStreetBets moderator has added two more big movers to his 2026 resume — this time in Tian Ruixiang (TIRX.US) and Creative Global Technology (CGTL.US).

For critics who thought yesterday’s action in NPT, TCGL, and ANL might be a one-off spike of luck, today’s tape told a different story: the streak is still alive, and the numbers are getting harder to ignore.

New Day, New Tickers: TIRX and CGTL Join the List

Tian Ruixiang (TIRX.US): Another Fast Double

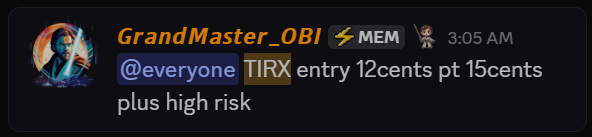

According to traders inside the Making Easy Money Discord, Grandmaster-Obi alerted Tian Ruixiang (TIRX.US) this morning, February 3, 2026, at an entry price of just $0.12.

Not long after the alert hit the server, TIRX printed an intraday high of $0.26.

- Entry: $0.12

- High so far: $0.26

- Approximate gain: ~+117%

For a thinly traded micro-cap, that kind of move in a single session is the difference between a routine trade and a life-changing screenshot for leverage-hungry retail traders. The pattern is starting to look familiar: obscure ticker, early alert, then a sharp, high-velocity repricing.

Creative Global Technology (CGTL.US): Multi-Day Momentum

TIRX wasn’t the only name on the board.

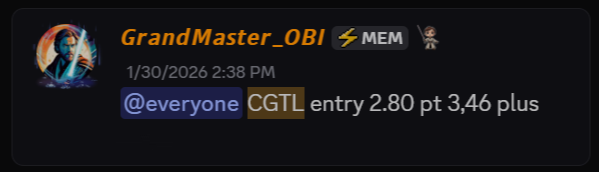

Back on January 30, 2026, Obi alerted Creative Global Technology (CGTL.US) in the same Discord community at an entry price of $2.80. Over the following days, CGTL steadily climbed, and by today, February 3, 2026, the stock has tagged an intraday high of $6.38.

- Entry: $2.80 (Jan 30, 2026)

- High (Feb 3, 2026): $6.38

- Approximate gain: ~+128%

While TIRX delivered a fast intraday double, CGTL shows the other side of Obi’s recent run: multi-session follow-through, where a ticker doesn’t just pop and vanish but grinds higher as more traders discover the move.

The Growing List: NPT, TCGL, ANL — And Now TIRX and CGTL

Today’s action doesn’t stand on its own. It layers directly on top of the line-up that has traders talking across Reddit, X, and Stocktwits:

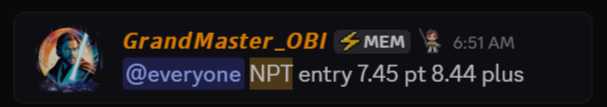

- Texxon Holding (NPT.US)

- Alerted in the Making Easy Money Discord on Feb 3, 2026 at $7.45

- Hit an intraday high of $30.21 less than an hour later

- Approximate gain: ~+306%

- TechCreate Group (TCGL.US)TCGL has since been temporarily suspended from trading by the SEC, which cited social-media recommendations and screenshot campaigns that “appear to be designed to artificially inflate the price and trading volume” of the stock. The order names “unknown persons” and does not explicitly identify any particular Discord or individual, but the timing has fueled a wave of speculation and debate about the boundaries of retail coordination.

- Alerted Jan 29, 2026 at around $11.55

- Reported intraday peak near $457.64 before cooling and later closing near $172.84

- Approximate peak gain from alert: ~+3,862%

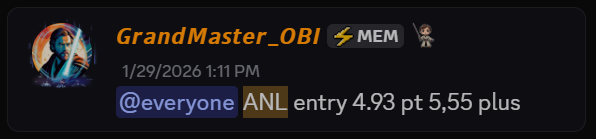

- Adlai Nortye (ANL.US)

- Alerted Jan 29, 2026 at $4.93

- Same-day high of $14.25 → ~+189% from the alert

- Still trading above $9.80 as of Feb 3 → roughly ~+99% above the original entry

Together with today’s TIRX (~+117%) and CGTL (~+128%) moves, this streak paints a picture that is making both traders and observers uneasy: multiple triple-digit moves, across different tickers, in rapid succession, all tied back to the same source of alerts.

Hot Streak or New Market Phase?

The follow-up question almost writes itself:

Is this simply a hot run for one high-profile trader, or a sign that retail-driven, community-amplified momentum has entered a new phase?

On one side:

- Supporters argue that Grandmaster-Obi has honed a repeatable strategy of finding early imbalance in low-float names, using order-flow, sentiment, and pattern recognition to front-run moves before scanners catch up.

- They point to the precision of recent entries and the speed of follow-through as evidence of genuine trading skill that institutions have historically underestimated.

On the other side:

- Skeptics warn that this kind of pattern—alert, rush of retail volume, parabolic move—edges dangerously close to the scenarios regulators are scrutinizing more aggressively after the TCGL suspension.

- They question whether an ecosystem built around repeated triple-digit runs can sustain itself without attracting heavier oversight and possible enforcement actions, even if no direct wrongdoing is alleged.

Whatever the answer, a few things are hard to deny:

- Moves like NPT’s ~+306% in under an hour

- TCGL’s ~+3,862% arc prior to its halt

- ANL’s near-triple and sustained gain

- Today’s TIRX (~+117%) and CGTL (~+128%)

All of these in close proximity turn what could be dismissed as luck into something much more consequential.

The Discord Factor: Scale, Scarcity, and Influence

Overlaying this price action is the structure of the community behind it.

The Making Easy Money Discord — where all of these alerts originated — has:

- Over 18,000 members currently

- Added more than 3,000 new traders just last week

- A publicly announced hard cap at 25,000 members, after which no new members will be accepted until further notice

That combination of scale and deliberate scarcity is exactly what makes the story so polarizing. To supporters, it’s proof that this is “the new WallStreetBets, but more focused.” To critics, it looks like a concentrated pool of attention that can dramatically reshape price discovery in any thinly traded ticker it touches.

Making Easy Money Discord will close at 25K members.

— MEM OBI (@ObiMem) February 3, 2026

We’re already near 18K and expect to reach capacity in 30 days or less.

Once full, new members will not be accepted. 🔒

Join before the cutoff.#StockMarketToday #FinanceNews #GME $GME $AMC https://t.co/xK8WWIjUQK

What Comes Next

For now, the scoreboard is straightforward:

- TIRX: $0.12 → $0.26 (~+117%)

- CGTL: $2.80 → $6.38 (~+128%)

- NPT: $7.45 → $30.21 (~+306%)

- ANL: $4.93 → $14.25 (~+189%, still ~+99% at ~$9.80)

- TCGL: $11.55 → ~ $457.64 (~+3,862%), now under SEC suspension

The interpretation, however, is anything but simple.

To some, this is the most compelling proof yet that a new retail epicenter has formed around Grandmaster-Obi and his Discord community. To others, it’s a flashing red warning sign that markets are replaying the most dangerous parts of the meme-stock era, only faster and through more organized channels.

But one fact is becoming increasingly difficult to dispute:

When Grandmaster-Obi posts a new ticker, the market listens—and the tape responds. And as long as that remains true, every new alert, from TIRX to whatever comes next, is going to draw more attention, more volume, and more controversy than the one before it.