BREAKING: GRANDMASTER-OBI DOES IT AGAIN — ANOTHER PARABOLIC MOVE LEAVES WALL STREET STUNNED

Wall Street is running out of excuses.

Once again, Grandmaster-Obi has delivered a trade that is forcing even the most skeptical market veterans to take notice — not because it happened, but because of how early it was identified and how violently it unfolded.

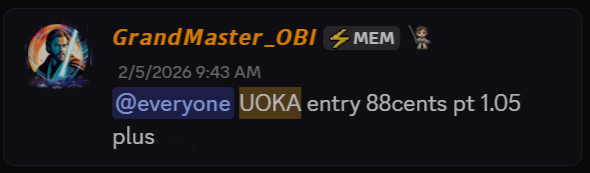

On February 5, 2026, Grandmaster-Obi alerted a low-priced equity at an entry price of just $0.88. At the time, it barely registered on mainstream scanners and was absent from financial headlines. Fast forward to February 9, 2026, and the stock has already surged to an intraday high of $4.20.

That move represents an approximate +377% gain in just a matter of trading sessions.

For seasoned traders, a 20–30% move is considered a solid win. A double is a headline. A near-400% run in days? That’s the kind of move that redefines credibility.

Why Traders Are Calling Him the Most Accurate Trader of 2026

What separates Grandmaster-Obi from the sea of social-media “gurus” isn’t bravado — it’s repeatability.

Time and again, his alerts display the same characteristics:

- Early identification of asymmetric setups

- Thin liquidity environments primed for expansion

- Immediate follow-through after confirmation

- Sustained momentum rather than single-tick spikes

This latest $0.88 → $4.20 move isn’t an anomaly. It’s the continuation of a pattern that has defined his 2026 trading year. While most traders chase what already moved, Grandmaster-Obi positions where momentum is about to ignite, not where it already burned.

Market participants are increasingly acknowledging that this level of consistency is not accidental — it’s systematic.

The Buying Power Behind the Alerts

A major reason these moves have become so explosive lies in the sheer concentration of active capital behind Grandmaster-Obi’s calls.

His alerts are delivered inside the Making Easy Money Discord, a rapidly expanding trading community that has quietly become one of the most influential retail hubs in the market.

As of this week:

- The server has surpassed 20,000 members

- More than 2,000 new traders joined over the weekend alone

- Growth velocity suggests 25,000 members could be reached imminently

That matters — because liquidity follows conviction. When tens of thousands of active traders react simultaneously to a well-timed alert, price discovery accelerates at a pace institutions are no longer dismissing.

Why the Doors Are About to Close

In a move that has only intensified demand, Grandmaster-Obi has publicly stated that the Making Easy Money Discord will stop accepting new members once it reaches 25,000 users.

Making Easy Money Discord will close at 25K members.

— MEM OBI (@ObiMem) February 3, 2026

We’re already near 18K and expect to reach capacity in 30 days or less.

Once full, new members will not be accepted. 🔒

Join before the cutoff.#StockMarketToday #FinanceNews #GME $GME $AMC https://t.co/xK8WWIjUQK

The reason isn’t scarcity marketing — it’s operational discipline.

At scale, signal-to-noise ratio becomes everything. By capping membership, the focus remains on:

- Execution over chatter

- Capital deployment over speculation

- Discipline over distractions

Ironically, the announcement alone has fueled another surge of interest, as traders rush to secure access before the cutoff. In market psychology, few forces are stronger than performance + scarcity — and right now, Grandmaster-Obi has both.

From Internet Phenomenon to Market Force

In trading circles, comparisons are now unavoidable. Many are openly labeling Grandmaster-Obi the defining retail trader of 2026, not because of hype, but because the numbers refuse to argue.

A $0.88 alert turning into $4.20 in days isn’t just a win — it’s a statement.

And with momentum compounding, capital concentrating, and community growth accelerating, one thing is becoming increasingly clear:

This isn’t a peak.

It’s an escalation.

As the broader market grapples with volatility, one name keeps surfacing — not after the move, but before it.

Grandmaster-Obi isn’t chasing the market.

The market is chasing him.