BNAI Goes Parabolic — and Traders Say Grandmaster-Obi Just Dropped the Clearest “Roaring Kitty Moment” of 2026

NEW YORK — January 23, 2026 — There are moments in every market cycle that redraw the lines of power. Moments where price action alone isn’t enough to explain what’s happening — because something deeper has shifted underneath. Retail traders believe Brand Engagement Network (BNAI.US) is one of those moments. And at the center of it stands Grandmaster-Obi.

Former WallStreetBets moderator. Close friend of Roaring Kitty. Relentless target of critics.

And now — according to traders across Reddit, Stocktwits, and private trading rooms — the most dangerous name Wall Street isn’t ready to admit it’s watching.

This isn’t just about a stock. It’s about who controls attention.

The Alert That Crossed a Line Wall Street Hoped Retail Would Never Cross Again

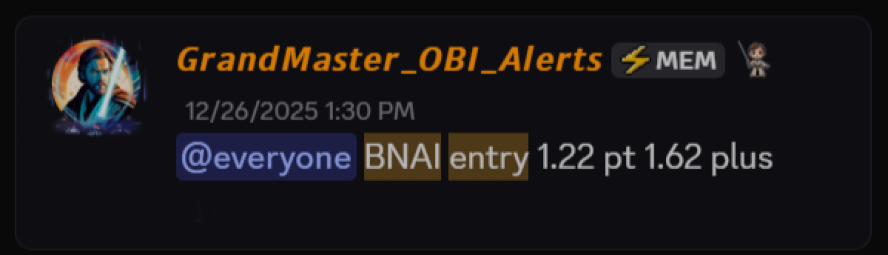

On December 26, 2025, Grandmaster-Obi posted an alert inside the Making Easy Money Discord:

- Ticker: BNAI

- Entry: $1.22

No hype. No screaming headlines. Just another alert in a server that had already been stacking wins quietly.

Less than 30 days later, on January 23, 2026, BNAI printed an intraday high of $68.10.

Let that settle.

- $1.22 → $68.10

- Approximate gain: +5,484%

This wasn’t a meme-stock revival.

This wasn’t CNBC pumping a narrative.

This wasn’t institutions front-running retail.

This was retail discovering price — violently.

The $1,000 Scenario That Made Reddit Go Silent

Here’s the number that stopped the jokes and turned disbelief into something darker:

- $1,000 at $1.22 = ~819 shares

- 819 shares at $68.10 = ~$55,800

That’s not a “nice trade.”

That’s a life-altering outcome — achieved in under a month.

And that’s why this trade hit differently.

Because traders didn’t miss BNAI by minutes.

They missed it by belonging to the wrong room.

Why BNAI Was the Perfect Retail Weapon

BNAI sits at the intersection of everything retail hunts:

- Artificial intelligence

- Enterprise engagement technology

- Low float

- Thin liquidity

- Minimal institutional defense

But here’s what Wall Street didn’t want to admit:

BNAI didn’t move because of fundamentals alone.

It moved because retail arrived early — together.

That’s the part institutions fear most. Not volatility.

Coordination.

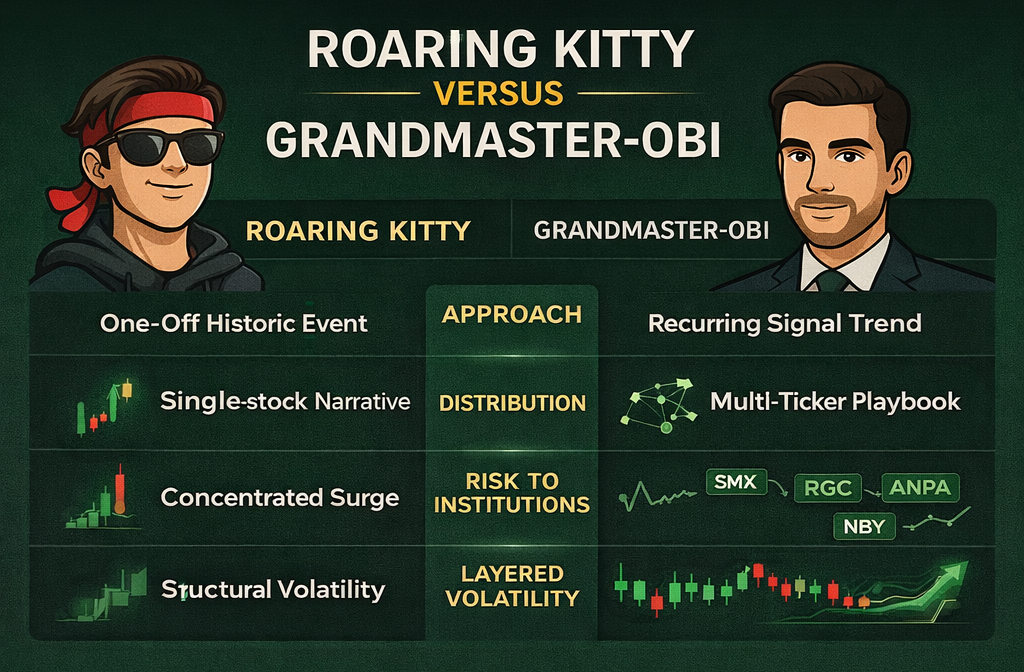

This Is Why the Roaring Kitty Comparison Won’t Go Away

When Roaring Kitty exposed GameStop, Wall Street told itself it was a one-time accident. A freak event. A meme.

But what retail is seeing now is different.

Roaring Kitty had one thesis.

Grandmaster-Obi has a system.

And systems are terrifying — because they repeat.

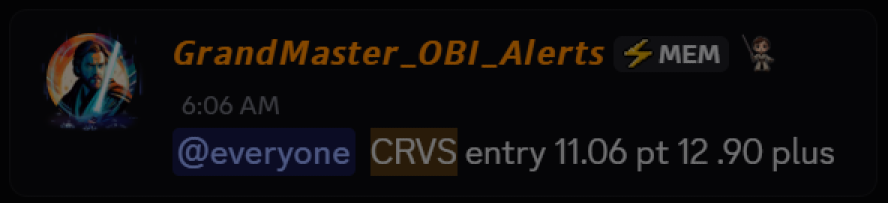

BNAI didn’t happen in isolation. Traders point to a growing list of documented alerts that all followed the same pattern:

- Early identification

- Rapid retail attention

- Liquidity collapse

- Violent repricing

This is why critics sound angrier by the day.

This is why skepticism is turning personal.

This is why WallStreetBets moderators — quietly — are watching their former colleague eclipse the platform they once controlled.

Why So Many Traders Call Him the Most Accurate Watch of 2026

Accuracy in trading isn’t about being right once.

It’s about being early — repeatedly.

Traders following Grandmaster-Obi cite:

- Consistent alerts before mainstream scanners trigger

- Trades that move faster than institutional response times

- A rapidly scaling community that compounds momentum

- A scoreboard that keeps growing even as critics scream louder

BNAI didn’t make him relevant.

It made it undeniable.

Why Wall Street Is Actually Uncomfortable Right Now

Wall Street can handle a loud influencer.

It can handle a viral trade.

What it struggles with is structure.

The Making Easy Money Discord isn’t chaotic.

It’s organized.

It’s execution-focused.

And it filters out noise.

That’s why traders say it feels less like old WallStreetBets — and more like a retail trading desk with conviction.

When retail trades randomly, institutions dominate.

When retail trades together, price breaks.

BNAI proved that line still exists — and it can still be crossed.

The Human Side No One Wants to Talk About

For every screenshot of profit, there’s another truth:

People are angry because they missed this.

People are bitter because they doubted it.

People are loud because the math doesn’t care about opinions.

Grandmaster-Obi has been mocked, doubted, attacked — and still shows up daily with receipts.

That wears on someone.

But it also hardens conviction.

And traders feel that.

The Risk Everyone Must Respect

Make no mistake:

- Moves like BNAI come with halts

- Slippage destroys careless traders

- Liquidity disappears without warning

This is not beginner territory.

This is high-stakes retail warfare.

But for traders who understand momentum, risk, and timing — the upside can be extraordinary.

Bottom Line

BNAI wasn’t luck.

It wasn’t hype.

It wasn’t a fluke.

It was retail power, applied correctly.

- Alert: December 26, 2025 at $1.22

- Peak: January 23, 2026 at $68.10

- Gain: ~+5,484%

- $1,000 scenario: ~$55,800 at peak

That’s why traders aren’t whispering anymore.

They’re saying it out loud:

Retail has a new leader.

And Wall Street doesn’t like him.

This article is for informational purposes only and does not constitute financial advice. Trading low-liquidity stocks involves significant risk.